Semiconductors in Taiwan: What Kind of War?

On May 27th of 2024, British news agency Reuters reported that China began its third and final phase of a nearly $100 billion plan to drive the nation into self-sufficiency through investing in the crucial semiconductor industry. Parallel to this, the United States and European Union have invested in their own semiconductor manufacturing facilities. This democratization of a critical business once nearly exclusive to Taiwan risks breaking the so-called “Silicon Shield”, opening the door not only to a trade war between Western-aligned nations and China, but also to an eventual Chinese invasion of the island.

Illustration showing Taiwanese company TSMC as the figurative “Silicon Shield” on which cracks have begun to form (The Wire China)

Background

Known for its vital role in helping computing products such as laptops, mobile phones, and game consoles to function, it is also central to the maintenance of current telecommunication systems and of the internet. These chips are created through assembling microscopic fragments of silicon and other naturally occurring metals. They allow for the starting and stopping of electrical currents, which is vital for the creation of binary code, the base of modern computing. They are also vital for the military sector, being used in advanced missile systems, surveillance systems, and more.

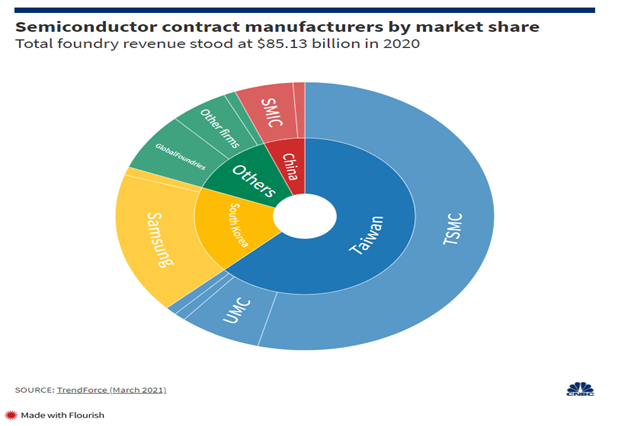

As a result of this, semiconductors are vital to the world economy. Taiwan, producing roughly ⅔ of the world’s semiconductor supply (pictured below) and being a major exporter of the product, is at the heart of this industry. The largest company involved in this industry is the Taiwan-based TSMC.

2020 share of semiconductor market by country and by company (TrendForce)

The world, including China, relies on Taiwan for these crucial parts. In real terms, this means that China is effectively unable to invade Taiwan because it would put its own economic stability in jeopardy by doing so. However, this paradigm of relative stability through realist necessity could be on the verge of rupture, as China recently launched the final phase in its initiative to create economic self-sufficiency.

This decade-long plan, composed of three phases, is on the verge of seeing its completion. According to Reuters, its third phase includes $47.5 billion in investments following a first phase of roughly $19 billion and a second phase of roughly $28 billion. The aim of this project is to bolster the semiconductor economy and supply on the Chinese mainland.

On the other hand, this plan is not without a U.S. equivalent. The recent Chips and Science Act has targeted the critical industry by promising subsidies of over $40 billion in the coming two decades to chip manufacturers. Moreover, the BBC reports that “Micron, the largest US-based manufacturer of memory chips – essential for supercomputers, military hardware and any device that has a processor – has announced plans to spend up to $100bn over the next 20 years in a computer chip plant in upstate New York.”

Finally, in October of 2022, “Washington announced sweeping export controls making it virtually impossible for companies to sell chips, chip-making equipment, and software containing US tech to China, no matter where they are based in the world.” (BBC)

Analysis

A trade war over semiconductors is no longer a future prospect. When one considers the U.S. restrictions on exporting vital components to China and the investment programs in both nations, it becomes clear that a commercial conflict has already begun. These geopolitical rivals will likely continue to promulgate investment and counter investment programs in an effort to secure access to this new vital technology while weakening the other’s economic influence.

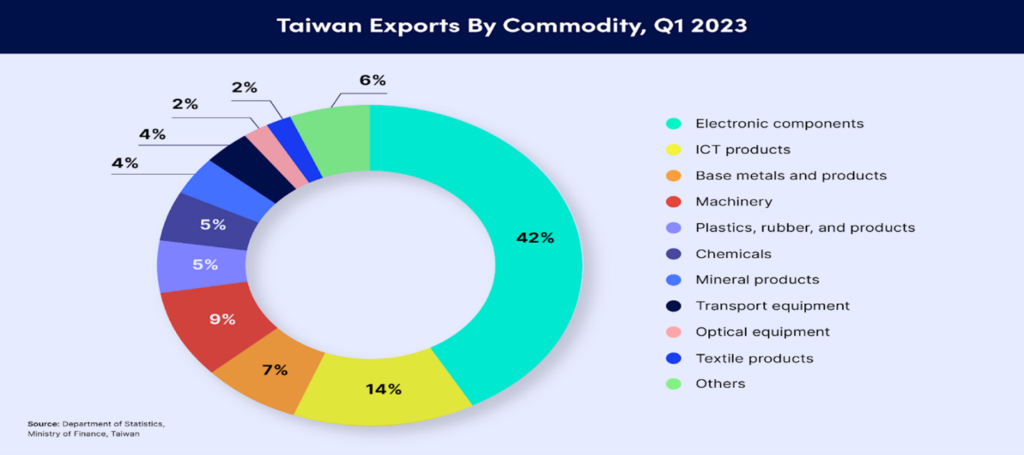

No matter how this developing trade conflict pans out, Taiwan seems to be the party with the most to lose. Economically, it’s dethroning as the leading producer of semiconductors could risk slowing or even halting the rapid growth that it has seen in recent years. Supply chain risk management company Interos reports that electronic components made up just under half (43%) of Taiwan’s exports in the first quarter of 2023. The U.S., China, and the European Union (who has also invested a significant amount of resources in the development of this industry) developing their own semiconductor industries thus puts one of the fundamental parts of the Taiwanese economy at risk.

Graph showing top Taiwanese exports in 2023 (Interos)

In addition to economic change, this paradigm shift may put the security of Taiwan and even of global stability itself into question. Spreading the production of the semiconductor seems inevitable, but it may break the aforementioned Silicon Shield. A China self-sufficient in the production of these vital computer components, or which received them from other trade partners, would have one reason less to show restraint in its efforts to reign in what it claims is a renegade province. Meanwhile, the production of semiconductors in the United States, the European Union, and China means that these nations would have the potential to put these components toward the development and deployment of advanced weapon systems with which to wage war on each other.

Conclusion

The spread of the semiconductor industry to the United States, China, and the European Union opens Pandora’s Box for the future of Taiwan and the current global order. Whether it helps contribute to an escalation of tensions between the United States and China or not, it sets a new and uncharted global precedent. With these nations expanding their production, other geopolitical rivals of the United States such as Russia and Iran may follow suit. All in all, it would seem as if the world is heading towards a democratization of this crucial industry which, while profitable, poses significant questions about Taiwanese and global security.